DLC rates in Rajasthan Explained (2022-2023) - Propira

DLC rates in Rajasthan Explained (2022-2023) - Propira

Learn everything that you need to know about DLC rates in Rajasthan, their types, recent changes, etc. to help you make the right real estate decision.

What is DLC Rate?

DLC rates stand for District Level Committee Rates. It is also known by various names in different states of India such as Ready Reckoner Rate, Circle Rate, Guidance Value, Unit Rate, and Collector Rate. It is the minimum rate which is used to calculate stamp duty or minimum value of the property at which the plot, apartment, house, or land is valued is called DLC rates. It directly relates to the applicable stamp duty on the property, which directly impacts property prices.

These rates can be found on the official websites of respective state governments. It must be noted that DLC rates are subject to change depending upon market trends and prices.

Types of DLC Rates

DLC rates are classified under different heads, such as residential, commercial, institutional, and industrial. DLC rates on Residential and commercial categories are further subdivided into exterior and interior subcategories.

- Residential Properties - It includes properties that are meant for residential usage. Further, these are categorized as premises that include farmhouses, flats/apartments.

- Commercial Properties - For the purpose of DLC rates commercial property includes showrooms, retail shops, eateries, banquets, malls, and restaurants.

- Institutional Properties - All educational, medical, government and community centers fall under this category.

- Industrial premises include Canteens and small cafeterias in the factories and industrial workplaces for industrial workers.

Now let's understand the concept of DLC Exterior and Interior rates.

DLC Exterior rate applies to a residential and commercial property that lies next to or beside the main road, the highway.

And if a residential and commercial property lies away from the main road or any highway(2.5 - 3 KM approx.).In this case, DLC Interior rates will apply.

How Can I Find DLC Rates in Rajasthan?

In Rajasthan, you can find DLC rates by following the below-mentioned steps. There are two methods to it you can use any of them:

|

No. of Steps |

Epanjiyan Portal |

IGRS Portal |

|

1 |

Visit the portal http://epanjiyan.nic.in/ |

Log on to the IGRS website https://igrs.rajasthan.gov.in/dlc-rates-revised.htm |

|

2 |

Then, click on the DLC Rate Information tab provided on the left panel |

Go to the Homepage ➜E-citizen tab➜ DLC Rates. You will be able to check both (Old)and (New)DLC Rates. |

|

3 |

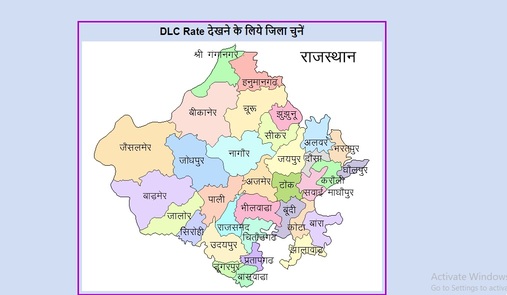

After that, you will be redirected to a map of the Rajasthan state |

You will be redirected to the epanjiyan website. Where you will find the DLC information tab showing DLC rates. |

|

4 |

Click on the district for which you want to check the DLC rate. |

A map will be displayed in front of you. Select concerned district on it. |

|

5 |

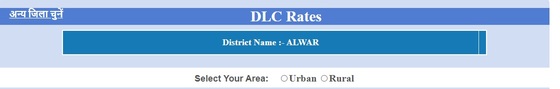

Then you will be asked to select Urban and Rural areas. Select them accordingly |

Select the concerned rural or urban area. |

|

6 |

Next, you will have to fill out some other necessary information. |

Select a desired particular area, colony name, captcha |

After filling in all such information as mentioned above. You will be able to get the old and new DLC rates of that particular region

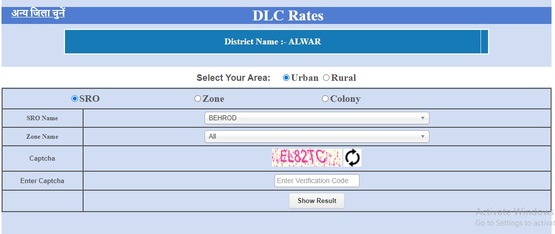

Now, for practical demonstration let us take an example. So let’s say you want to check DLC Rates in Alwar or its major emerging areas like Bhiwari, Neemrana, Behror, etc.

Use any method as mentioned above, We will see how to check DLC rates using the epanjiyan portal

Step 1 - When you visit the epanjiyan portal. You will see a page like this.

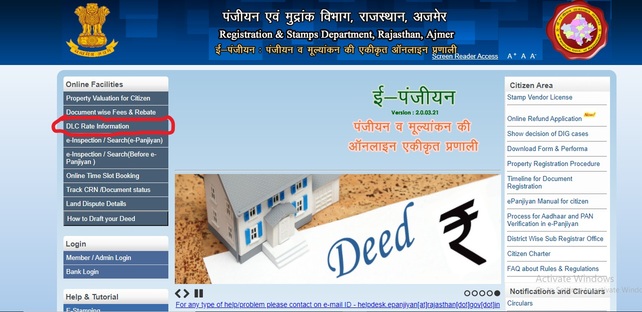

Step 2 - Click on DLC Rate Information

Step 3 - Select Alwar on the map

Step 4 - Select Urban or Rural Area

Step No 5 - Choose and Select your SRO zone, Area or Colony

Here we are checking DLC rates for Behror, Alwar

Step 6 - Do Captcha Verification ⇒ Click Show Results to see DLC rates

Check the DLC Rate in Rajasthan Online Video Here

Changes in DLC rate Rajasthan

DLC rates are decided by the committee, which involves MLA and the concerned district collector. In 2017, the DLC rate for residential properties was raised to 17% without consulting the stakeholders like developers and buyers, which resulted in an imbalance in the property market.

In response to this Real estate developers in Rajasthan, demanded that DLC rates should be lowered by 30%.

The State Government revised the rates by keeping in view the fact that market values are far lesser than a fixed value. So they say that the DLC rates of commercial properties should not be higher than the residential properties either.

The Rajasthan budget 2021-2022 did seems to accommodate the plea to an extent. While presenting the state budget in assembly, the Ashok Gehlot government slit the DLC rates by 10% and decreased the registry rates for flats up to Rs. 50 lakhs. Taxes on Agriculture, health, and education sectors have been repealed/withdrawn.

How did DLC rate reduction boost Rajasthan Real estate market?

State Government decisions about reducing DLC rates and stamp duty boost the real estate market. This reduction increased the demand for housing and provides additional benefits to home buyers.

In 2021, they reduced the stamp duty to 4% from 6% to cope with an economic downfall in the real estate sector. As the covid19 period has adversely affected the industry, reducing DLC rates has opened up the industry again. As with decreased DLC rates, the demand for housing units has increased, giving opportunities for buyers and sellers.

Key Takeaways:

- Stamp duty in Rajasthan is 6% for men and 5% for women.

- DLC rates of Rajasthan can be checked on the IGRS Rajasthan website or through the epanjiyan website.

- DLC is the land valuation rate based on the average rates laid down by DLC(district-level committee)for registration of sales deeds under the stamp and registration Act.

- DLC rates can also be ascertained by downloading the Google play store application.

We hope that you have enjoyed the information provided and gained some new and interesting insights about DLC rates. We would like to hear from you about your opinion and views.

Check DLC Rates In Other States

1. Noida

2. Gurgoan

3. Delhi

4. Haryana

More from Propira

Write Comment