Complete Guide on Rajasthan Property registration Details.

Complete Guide on Rajasthan Property registration Details.

Learn everything about Rajasthan Property Registration Details

Guide to Rajasthan property registration and stamp duty charges. Registration of property in Rajasthan is managed by the Registration and Stamp Department of Rajasthan and It is governed by Rajasthan Registration Act, 1955.

Introduction

Registering your immovable property is the most important thing. It should be your priority to make sure that the property registration process is done properly and complete when purchasing a home, commercial store, or piece of land.

A person is considered the legal owner of a piece of property only after registering it in his/her name. Legally, a property sale is not valid until the sale deed is properly stamped and registered.

Property registration process in Rajasthan is governed by the Rajasthan Registration Act of 1955.

Complete Process of Property Registration in Rajasthan

Let us understand the complete process of how registering property in Rajasthan step by step.

Complete Outline of Property Registration

Property registration includes

- Drafting of documentation

- Payment of the relevant stamp duty

- Payment of registration fees

- Recording of the deed at the sub-registrar’s office.

- Then, the Registration and Stamps department oversees the complete tasks and procedures of registration and transfer of a Real estate in Rajasthan.

Most Importantly, All transactions involving the sale of real estate should be recorded to assure the transfer of ownership to the buyer.

Other main aspects mentioned in the Act:

Section 17:

According to Section 17, It is necessary/must to complete the registration under the following cases as discussed below:

- Instruments of the gift of immovable property.

- Lease of immovable property for any duration exceeding one year.

- Instruments that create or renounce any right and immovable property with a value over Rs.100.

Section 18:

Under this section of the Rajasthan Registration Act of 1955. Some legal arrangements/provisions are made to cover some cases of Optional registration for

lease of real property for terms no longer than one year

Instruments purporting to create, declare, assign, restrict, or abolish rights, titles, or interests in moveable property and wills.

Let us dig deeper to understand some important aspects involved in the process to make our understanding clear.

What is stamp duty?

Governments impose stamp duty on legal papers/documents, typically during the transfer of assets or property. To break it simpler you may assume them as the tax that the government imposes to facilitate the transfer and registration of properties.

Features of A stamp duty-paid instrument or document are

- Deemed lawful and legal

- Possesses evidentiary value

- It is admissible in court as proof.

Why It is Important to Register Your Property?

The benefits of registering immovable property are as follows:

- Once the property is registered at the Sub-office, Registrar's transfer document will become a permanent public record.

- This public record is accessible to all citizens, and a certified copy can be acquired from the Sub-office. Registrar's

- The purpose of property registration is to tell the public that the seller has transferred title to the buyer.

- A citizen can determine who registered the most recent transfer deed.

Documents Needed

Step by Step Process – How to do it

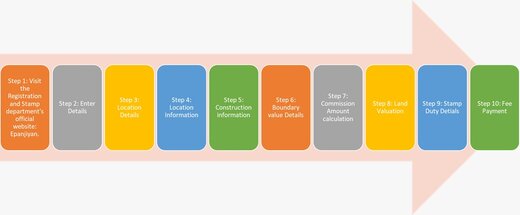

Follow these detailed step-by-step instructions to register your real estate in Rajasthan:

Step 1:

Visit the official website of the Registration and Stamp department: Epanjiyan.

Step 2:

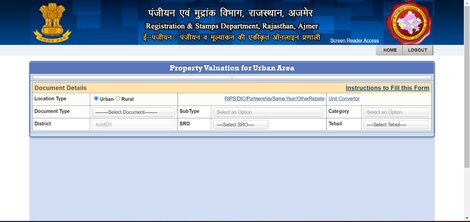

From the homepage, select the property valuation option. Enter your district and cellphone number and verification code on the new page. To register immovable property, click on "fresh valuation."

Step 3:

In the box for document details, the applicant must indicate the property location type. Select sale deed as the document type and certificate of sale deed as the subtype. Give District, SRO, and Tehsil information.

Step 4:

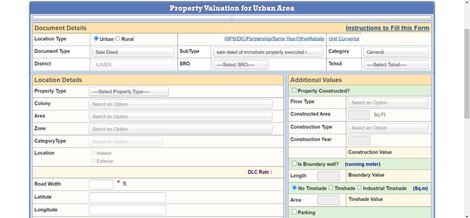

For the property to be registered, the applicant must give the following location information:

Step 5:

In addition to the values section, the applicant must include construction-related information, such as floor type, constructed area, type, and year, if relevant.

Step 6:

provide boundary value details such as length, tin shade, area, parking information, and tube well information. On the basis of these values, the property value will be determined.

Step 7:

After selecting the appropriate commission (Jail/Senior citizen/others/NA), the commission amount will be determined.

Step 8:

After entering all information, click "Save property details" The system will then automatically produce or compute the Land value based on the plot area and land values. The land value will be displayed. After confirming the property's value, click the Next button.

Step 9:

The applicant will reach the stamp duty page by selecting the Next button. They must provide the Execution Date, the Face Value, and the Evaluate Value (will be shown). After entering the required information, click Calculate Stamp Duty.

Step 10:

These fees can be paid for the registration of property in Rajasthan. Click the save button to proceed with the application.

Step 11:

By selecting the 'Proceed to Party Details' option, the applicant can provide the party's kind, name, presenter type, gender, category, contact number, ID proof, and address.

Step 12:

The applicant is required to upload all supporting papers. Take a printout of these forms, and after completing them, scan them into PDF for uploading.

Step 13:

After uploading the documents, click the upload and save button. After completion, click "Done and Exit"

Step 14:

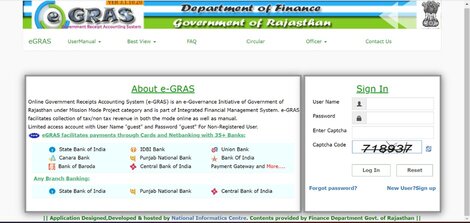

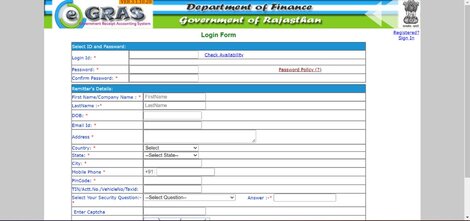

After picking the Payment option, the link will be routed to the e-GRAS page. If the applicant is already a registered user, use their username and password to log in to the portal.

Step 15:

To register for the first time, click the Sign-Up button and submit all required information. After completing registration, log in to the portal and make payment.

Step 16:

Select Registration and Stamp Department as the department, then provide the department head and click submit. Applicants must now submit an application for e-Chelan.

The applicant can pay using Manual, e-Banking, Credit or Debit Card.

Step 17:

After payment, the applicant will navigate to the e-panjiyan website and click the Time slot booking button. Select a day from the provided list to approach the SR office.

Step 18:

Enter the CRN number in the field provided, an OTP will be issued to the registered cellphone number, and the same number must be entered for time slot booking.

Step 19:

On the specified date, the applicant must attend the appropriate Sub Registrar Office with the Citizen Reference Number and the Fee Receipt. The SRO office will import data from the citizen reference number and review all of the information entered. In the event of a manual form of payment, the funds must be paid directly through the SRO.

Step 20:

After the application has been approved, the SR office will take a photo and thumb impression of the presenter, executors, claimant, and witness. After photographing the document, SRO will generate an Endorsement and register it. The applicant may obtain the property registration paperwork following successful registration.

Rajasthan Property Registration and Stamp Duty charges

|

Ownership |

Stamp Duty and |

Registration Charges |

Labour Cess |

|

Men |

6% |

1% |

20% of the stamp duty |

|

Women |

5% |

1% |

20% of the stamp duty |

Conclusive Note

As we have covered the process of property registration in Rajasthan in detail, this is evident that the process is very easy. We have also discussed the importance of property registration.

In light of the above-mentioned benefits, all the property owners in Rajasthan should get their properties registered and avoid unnecessary legal consequences.

Also Read Possession Certificate-Complete Definition and Documents

Propira is a top real estate consultant and agency in Alwar, Rajasthan. We deal in buying, selling, and renting commercial, residential, and agricultural properties in alwar.

We hope you have liked what you read!! Now it is time to hear from you.

Write Comment